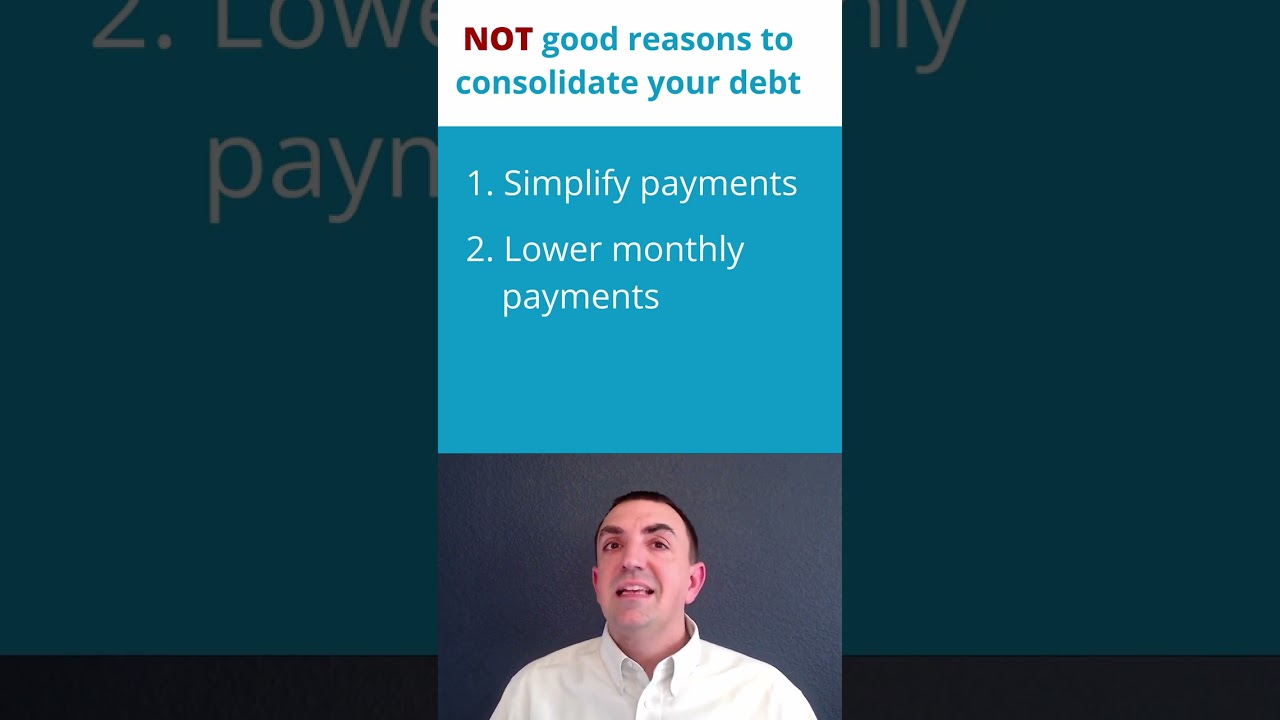

The three reasons that are NOT good reasons to take a debt consolidation loan are:

1. Simplifies your payments: While consolidating debt can simplify payments by combining multiple debts into one, it doesn’t fundamentally change your financial situation. It may create the illusion of improved financial health, making it easier to manage monthly payments. However, the key issue is addressing the root cause of the debt. If spending habits and financial management aren’t improved, the simplicity of payments won’t prevent further debt accumulation.

2. Lowers your monthly payment: A lower monthly payment resulting from a debt consolidation loan may seem appealing, but it can be misleading. If the reduction in monthly payments comes from extending the repayment period, you might end up paying more in interest over the life of the loan. While lower monthly payments may provide short-term relief, the long-term cost may outweigh the perceived benefit.

3. It will get you out of debt: Taking a debt consolidation loan doesn’t inherently eliminate debt; it merely restructures it. If the underlying financial behaviors that led to the accumulation of debt are not addressed, there’s a risk of falling back into the same patterns. It’s crucial to recognize that debt consolidation is a tool, not a solution. True debt elimination requires a comprehensive approach that includes addressing the root causes of debt, budgeting, and financial discipline.

The only good reason to take out a debt consolidation loan: The only sound reason to consider a debt consolidation loan is to decrease overall interest expenses. By securing a lower interest rate, more of each payment can be allocated toward the principal, facilitating faster debt repayment. This strategy, when combined with responsible financial habits, can help individuals become debt-free more efficiently.

Debt consolidation should be approached cautiously, and individuals should be aware of potential pitfalls. It’s essential to use this financial tool strategically, focusing on reducing interest costs and actively working towards a comprehensive plan for financial stability and debt elimination. Simply rearranging debt without addressing its root causes may lead to a false sense of security and perpetuate a cycle of indebtedness.

To check to see what rate you could get for a debt consolidation loan, visit our marketplace page: https://theyukonproject.com/debt-consolidation-loans/

#debt #debtfree #debtfreejourney #debtpayoff #debtmanagement #debtrelief #debtproblems #debtconsolidation

Website: https://theyukonproject.com

Instagram: https://www.instagram.com/yukon_project/

Facebook: https://www.facebook.com/theyukonproject

YouTube Channel: https://www.youtube.com/@theyukonproject

Apply for a personal loan: https://theyukonproject.com/product-comparison/compare-personal-loans/

Apply for a consolidation loan: https://theyukonproject.com/product-comparison/debt-consolidation-loans/

Apply for a credit card:https://theyukonproject.com/category/credit-cards/

Tailored & actionable steps to a 700 credit score

Build Credit with our FREE service: https://theyukonproject.com/free-credit-consultation-to-improve-your-credit-score/

Find a financial Advisor: https://theyukonproject.com/product-comparison/find-a-financial-advisor/

Find the right savings, checking, CD, Account for you: https://theyukonproject.com/find-the-perfect-savings-or-checking-account-for-you-with-the-right-bank/